Public-Private Partnerships

We have a diversified group of investors comprised of financial institutions, sovereign wealth and pension investment funds, holding corporations, infrastructure banks from Europe, North America, and Asia who invest alongside the firm, its partners and influential individuals.

Public-Private Partnerships

We have a diversified group of investors comprised of financial institutions, sovereign wealth and pension investment funds, holding corporations, infrastructure banks from Europe, North America, and Asia who invest alongside the firm, its partners and influential individuals.

Governmental Affairs and Advocacy

To meet the economic and social challenges of the citizenry worldwide, governments must transform the way they think, organize, and execute. We help federal, state, and local governments improve their efficiency and effectiveness, enabling those to better fulfill their missions to the public sector. We bring an investor mind-set to public-sector policies and support private investments needed to enable opportunities. We offer global experience and relationships, a network of talented consultants, distinctive expertise and capabilities, and sustainable purpose-built methodologies.

Humanitarian Aid and Emergency Disaster Assistance

We support agencies at both a global and regional level, partnering with local experts to provide strategic and technical support locally, helping them meet their development goals across multiple sectors including education, finance, public health, and sustainability.

Federal Transportation and Infrastructure Solutions

As part of our responsibilities to our shareholders and clients, we advocate for public policies that we believe are in the long-term best interests of our stakeholders and clients. We engage in issues and participate in market-level dialogue to contribute to the development of policies and practices that support stewardship, long-term investing, and value creation.

Policy and Regulatory Support

Our risk and regulation experts work with clients to address the impact of new regulatory requirements and to seize market and competitive opportunities arising from regulatory change. We help government agencies and private-sector organizations design and implement strategies that promote economic development and inclusive growth.

Supporting a Community-Led and Equitable Governance that Advances Infrastructure Policy

Supporting a Community-Led and Equitable Governance that Advances Infrastructure Policy

We leverage analytics to help improve the quality of life for citizens and to support companies and governments to be more productive. Our implementation consultants help organizations accelerate execution to achieve long-term measurable performance, with bottom-line results.

Executing A Critical Infrastructure Risk Management Approach. Designing an effective, high-performing organization is hard work. It requires an integrated and accurate view of the organization, the ability to visualize massive amounts of data, and a way to collaborate across silos all the way down to the individual job description. Working with senior leaders, we help public-sector organizations set a vision for strategic outcomes, build a robust fact base, rigorously assess options, design an actionable plan, win support from key stakeholders, and evaluate progress from design through execution to ensure that strategies have lasting impact. Drawing on insights from the private sector and decades of public-sector work, we support clients on a range of strategic topics, including identifying economic and technology trends; synchronizing budgeting and strategic-planning processes; designing stakeholder-engagements; and creating innovation programs.

Helping Federal Agencies Redesign their Approach and Improve their Operational Capabilities

Helping Federal Agencies Redesign their Approach and Improve their Operational Capabilities

We serve top oil and gas companies, energy generators, pipeline operators, distribution power utilities, traders, and industrial buyers. We help financial institutions, governments, and corporations understand market developments, engage constructively in regulatory debates, and strengthen their capabilities for managing external stakeholders.

Commodities, Futures, and Derivatives. Risk management has become a boardroom priority, not only for financial institutions—which must carefully consider market risk when managing their trading positions and funding their balance sheets—but also for corporations, which are exposed to commodity-price volatility and fluctuations in foreign-exchange rates. The recent economic downturn highlighted the degree to which company earnings are vulnerable to market volatility. We assess the impact of regulatory changes on market-risk-management practices, and we support clients in building tools and approaches as they adjust to regulatory requirements.

We help private companies and public-sector organizations make better and more informed strategic decisions through a deeper understanding of the evolution of industrial power markets and technological developments. Supported by experts in technology and capital markets, our teams work closely with clients to develop and interpret scenarios, benchmark performance against industry peers, and strengthen capabilities for managing uncertainty.

Project Management Solutions

Our implementation experts bring decades of industry experience and a track record driving change in complex organizations. These exceptional change leaders coach clients, improve and transform workforce development systems, rollout performance management technologies, and build capabilities that enable a step change in performance.

Project Management Solutions

Our implementation experts bring decades of industry experience and a track record driving change in complex organizations. These exceptional change leaders coach clients, improve and transform workforce development systems, rollout performance management technologies, and build capabilities that enable a step change in performance.

We help our clients achieve impact from strategy through implementation. Our capability building experts and leadership facilitators deliver blended learning journeys to build the skills required to sustain the change, working shoulder-to-shoulder with our clients.

Innovating with Oracle Technology Partners. Companies often struggle with their strategic-management and planning processes. It can be challenging to reconcile the pressure for short-term returns with long-term strategic goals, and it's difficult to build the capabilities needed to execute strategies. Companies must sharpen their ability to think strategically, learn how to allocate scarce resources effectively in the face of competing demands, and continually innovate. We help our clients achieve impact from strategy through implementation. We help companies strengthen their strategy-development processes and make better decisions. We deliver predictive project analysis by coupling historical project results with forward-looking engineering, procurement, and construction intelligence to build a fact-based range of schedule outcomes. Generative scheduling helps discover the best path, enabling an accelerated execution strategy.

The organizations we work with are complex. Our clients are seeking solutions that break down silos, bridge the gap between systems, and consider all the elements that contribute to the challenges they face. Only a few are looking for stand-alone solutions that work independently of the enterprise. Organizations are seeking solutions that are proven to positively influence their outcomes. Building capabilities translates directly into performance improvements on the individual and organizational level. Our implementation experts partner with clients to drive and sustain execution, ensuring change lasts long after we're gone. We often redeploy the execution assessment to resolve obstacles to impact. Our capability building experts and leadership facilitators deliver blended learning journeys to build the skills required to sustain the change, working shoulder-to-shoulder with our clients.

We know that today’s challenges demand more than a one-size-fits-all training approach. Cognitive research has consistently shown that “learning by doing” is the best method—it accelerates learning and enhances retention. Our custom on-site workshop is designed as an interactive and discussion-oriented session, where participants learn from the experience and wisdom of other executives and senior leaders. We build custom programs that fit each organization’s unique context and learning objectives and can transform large groups of managers. Our combination of business and construction expertise uniquely positions us to support both private and public sector clients.

Our proprietary knowledge and solutions allow us to bring an array of offerings to help our clients transform their end-to-end operating models. Our offerings include:

Defining the Role of Scale for Large-Complex Engineered Structures and Towers

Defining the Role of Scale for Large-Complex Engineered Structures and Towers

We have helped deliver a wide range of real estate development projects, including luxury condominiums, mid-rise and high-rise buildings, neighborhood developments, and private estates.

Unified Project Execution—Integrated Project Delivery. We help maximize returns for large-scale developments by applying insights on changing community and tenant needs, optimizing capital costs, industrializing and accelerating project delivery, minimizing risk, and ensuring that stable foundations are in place for long-term, sustainable revenue streams. Smart development and financing can mean the difference between a successful project and one that falls short. Our project-development work is focused on helping bridge the current gap between infrastructure and needs by convening the right parties and working collaboratively to establish viable, bankable projects.

We support project development, procurement and contracting, project execution, and distressed project turnarounds. We help deliver large, complex real estate projects on time and on budget with leading-edge approaches, including experience-design optimization, collaborative contracting, standardization and modularization, and real-time productivity management of field activities. Our teams bring together renowned experts in their respective fields. Emerging designers work alongside project leads, architects collaborate with engineers, and all of us learn from each other. Through our research initiatives and our collaborations with innovative practitioners, from artists to scientists, we’re constantly pursuing new avenues in design.

We help clients understand the potential for value creation, including opportunities to improve an asset’s cost position, operating performance, capital project execution, regulatory management and—if possible—opportunities for revenue growth. To ensure the long-term success of an investment, we assist clients in identifying, analyzing, and managing project risk. We bring integrated teams of partners and consultants, as well as senior experts with decades of experience designing technical solutions and running megaprojects across industries. This combination of best-in-class technical, financial, and project-execution expertise, backed by our robust project-management methodology and depth of experience, allows us to deliver superior value to the customer.

Improving Project Predictability and Performance with Collaborative Design-Build Contracting

Improving Project Predictability and Performance with Collaborative Design-Build Contracting

We go beyond “lines and boxes” to define decision rights, governance, accountabilities, and integrity. Our design, engineering, and management solutions help clients manage complexity to ensure sustained performance.

Construction Manager as Owner's Advisor (CMa). By establishing a collaborative, multi-disciplinary working environment we can increase productivity and foster innovation across the organization. We identify and evaluate early-stage projects and apply strategic levers to improve project business cases significantly. We also optimize design, procurement, and the critical enablers – organization, culture, capabilities, risk, contracting, digital and analytics – to realize the full potential of the project. As a discipline, design is more than pleasing the eye. Companies that have placed design at the center of the organization perform better. Design thinking is a disciplined way to interrogate data, behavior, and preferences to find the gaps between what exists today and what customers would highly value. It is the heart of a holistic approach to deeply understand customers to better meet their needs. This kind of analysis is a necessary foundation to make a creative leap that results in something entirely new. We combine rigorous analytics, inspired creative teams, and deep functional and industry expertise to deliver rapid growth for our clients and to create value for their customers.

Our Work Spans Multiple Sectors, Including Operations, Consulting and Advisory Services

Our Work Spans Multiple Sectors, Including Operations, Consulting and Advisory Services

We deliver prompt, sophisticated, and multidimensional strategic guidance designed to minimize risk and effectively remediate problems and vulnerability. We help clients design and implement integrated cost, schedule, and risk management solutions and bring a risk-reward perspective to strategic decision-making.

Maximizing Value through Pre-Construction Services. We have a dedicated team of experts, including senior professionals with specific asset and discipline expertise, ready to be deployed worldwide and at all stages of project execution, from design to start-up. We provide risk identification, assessment, and mitigation; support rigorous project and performance management; and drive accelerated project commissioning and ramp-up. We have refined a number of tools and offerings for our clients that support successful project delivery and help create world-class project organizations. Project value optimization is a continuous process, and we work with clients to identify opportunities for improvement. At each key milestone in the design phase, we perform value-optimization exercises. This process enables organizations to improve the overall project value by minimizing the total cost of ownership of equipment, simplifying logistics and storage, improving constructability and productivity during the construction phase, and maximizing yield. We work with our clients to apply best practices at the onset of a project that will impact positive delivery, maximize value, and minimize waste.

Whether focused on resource planning for an enterprise or strategic planning for one or more projects, our recommendations are grounded in the same principles. Our portfolio of earned value and schedule management solutions encompasses an array of integrated capabilities designed to give our clients the full support they need to meet their project’s scheduling objectives. Our experts collaborate with project teams to develop feasible, coordinated schedule update strategies. We work with clients on issues relevant to the resource management of the schedule, such as resource assignments, earned value management, productivity strategies, the cumulative impact of change orders, and time impact analyses. Our work consistently results in improved productivity, shortened schedules, and reduced costs.

We combine our expertise in risk management with deep experience in and understanding of our clients’ business contexts, developed through decades of experience counseling our clients. We work closely with senior expert advisers— external collaborators who bring decades of industry, regulatory, and academic experience. Our teams, including senior advisers with extensive institutional, government, and military experience, have helped business and government leaders manage many serious cases and their aftermaths. Our areas of quality expertise include development of compliance strategies, quality performance and cost benchmarking, optimizing the quality management system, delivering compliance and remediation services, fostering a quality culture.

A Practical Framework for Delivering Capital Improvement Projects

A Practical Framework for Delivering Capital Improvement Projects

We work alongside our clients to help effectively manage their capital projects and portfolios throughout the entire lifecycle, from setting an initial capital strategy through portfolio planning and design to execution.

Reimagining Engineering to Deliver More Projects, More Efficiently. Our team of engineering, industry and finance professionals assist clients through the entire capital project lifecycle, helping to mitigate risk and navigate disruption. We partner with organizations to define strategic direction, optimize capital spend, and build enterprise-wide capabilities, including designing digital transformations. We identify and evaluate early-stage projects and apply strategic levers to improve project business cases significantly. We also optimize design, procurement, and the critical enablers – organization, culture, capabilities, risk, contracting, digital and analytics – to realize the full potential of the project. We help deliver projects through a disciplined execution rhythm to accelerate schedules, improve safety outcomes, maintain quality, and reduce costs. This end-to-end value assurance and optimization support, tailored to major projects, can be further enhanced by full-time support from experts embedded in the leadership team.

We provide a wide range of support throughout the project-development phase. Our activities during this period include performing due diligence, developing and managing a business plan, establishing a project-management-office function to support the development and management of third-party contractors, and conducting risk assessments. Through functional expertise across all aspects of capital projects and operations, we offer both targeted initiatives and broad, long-term support to optimize project spend and operations, prioritize projects and investments across a project portfolio, and accelerate delivery by working alongside our clients—building the capabilities of client teams and serving as project managers. We help project owners identify the optimal strategy to raise financing for their project by drawing on our knowledge of the range of available tools and instruments, in-depth expertise on the assets under development.

We partner with businesses, communities, nonprofit organizations, and government leaders to achieve high life-cycle returns for their capital projects, in less time and with greater predictability, by moving from traditional activity-focused schedule management to a project management approach for end-to-end delivery strategy. We emphasize growth and sustainable returns for long-term performance. Our fast, objective, and independent perspective is anchored in the trends, disruptions, and dynamics that shape our clients’ industries. We also deeply examine operating-model changes required to unlock value.

Extraordinary Complex Programs and Projects Demand Exceptional Teamwork and a Strategic Approach

Extraordinary Complex Programs and Projects Demand Exceptional Teamwork and a Strategic Approach

Making megaprojects a source of competitive advantage by aligning strategy, enhancing value, and delivering predictable outcomes. The scale and ambition of these extraordinary projects require close collaboration between multiple disciplines. We support clients on asset planning and prioritization, financial projections, and contracting strategies (including public-private partnerships) to manage and control risk.

We Help Deliver the Extraordinary for Complex Programs and Projects. Ignoring high-consequence, extraordinary risks can be damaging to an organization but preparing for everything is costly. Extraordinary projects need vision and precision to be exceptional, they demand a team that understands mutual trust and integrity are necessary to execute massive undertakings on near-impossible deadlines. We help our clients have the strongest possible starting point for their large projects by establishing a tailored procurement strategy, structuring contract-award negotiations to realize early cost savings and building the required management infrastructure. Our team provides a unique combination of project development and financing expertise, relationships with key stakeholders, and proprietary tools and data that enable us to serve as trusted partners to governments, private developers, and investors. Our project-development work focuses on helping bridge the current gap between infrastructure investment and needs by convening the right parties and collaborating to establish viable, bankable projects in which investors can be confident. Our team uses several flexible models to help our clients source projects, accelerate development, match projects to financing, and build project-delivery consortiums.

Our teams—representing a unique combination of strategic advisors and senior practitioners with decades of hands-on experience—work alongside clients to create value and impact that other traditional project participants may miss or ignore. We help clients plan, execute, and, in some cases, rescue multibillion-dollar mega projects. Our business acumen, on-the-ground experience, and comprehensive knowledge of functional topics—such as organizational effectiveness, lean execution, procurement management, and risk management—uniquely positions us to support capital project owners, investors, and institutions.

Managing Project Risk and Uncertainty

We help institutional investors—particularly large public pension plans, sovereign-wealth funds, and endowments—better understand the risk and return potential of their portfolios. We help clients analyze risk factors, model liability, and enhance their asset-allocation methodologies.

Managing Project Risk and Uncertainty

We help institutional investors—particularly large public pension plans, sovereign-wealth funds, and endowments—better understand the risk and return potential of their portfolios. We help clients analyze risk factors, model liability, and enhance their asset-allocation methodologies.

Our value proposition is concentrated on formulating program and project solutions that create business value, both as engineers and architects of innovative solutions and construction management consultants.

Dedicated Oversight and Decision-Making Support. We work with leading companies, frequently on matters that are unprecedented in size, scope and complexity. We help institutional investors—particularly large public pension plans, sovereign wealth funds, and endowments—better understand the risk and return potential of their portfolios. We help clients analyze risk factors, model asset and liability matching, and enhance their asset-allocation methodologies. We also help them disaggregate the sources of investment performance and costs to get a fuller view of their risk-adjusted returns. Increasingly, we help investors use insights from big data and machine learning to stay at the cutting edge of their disciplines. We embed these insights into ongoing investment and risk-management processes to help clients build lasting capabilities. We help investors to finance projects and infrastructure in a way that supports sustainability goals, drawing on our unique ability to combine investment expertise with deep insight into environmental issues.

Mission Critical Data Centers

We help our clients harness the power of data and artificial intelligence, modernize technology and capitalize on new technology, optimize and automate operations, fuel digital experiences, and build digital talent and culture.

Mission Critical Data Centers

We help our clients harness the power of data and artificial intelligence, modernize technology and capitalize on new technology, optimize and automate operations, fuel digital experiences, and build digital talent and culture.

We help national, state, and local public institutions better serve their constituents by leveraging technology to improve existing services and deliver new ones. We help incumbents and new entrants in the physical security and infrastructure markets craft strategies to succeed.

Building Value Through Proprietary Innovation. The rise in complexity—defined as the number of calculation steps required to reach a solution, is being driven by the rapid growth of three variables: data, interconnectedness, and the speed of change. Our clients are looking for new ideas, new products, and new systems at scale—and they want to build the capabilities to deliver on these while creating a lasting competitive advantage. We complement our rigorous problem-solving with engineering and user-centric design thinking. We leverage our vast data repository, analytical models, and industry expertise to address your most critical needs, working with your teams to customize a solution for you. Achieving this goal often means building custom tools that can operate within your systems and training your engineering, procurement, and construction teams to ensure that impact is sustainable over time.

Our Track Record of Performance is driven by Partnership, Client Service, Strategy, and Integrity

Our Track Record of Performance is driven by Partnership, Client Service, Strategy, and Integrity

We work with leading logistics companies across a range of topics, including construction, applying analytics and developing operational cost efficiencies that drive value. Together, we help companies get things where they’re going quickly, accurately, and efficiently.

Seaports, Harbours, and Maritime Terminals. Ships are vital to worldwide trade. Container ships are among the largest oceangoing vessels, the pack mules of the global economy. The growth of ocean freight is far stronger than the growth of any other shipping sector. Industry leaders today face unprecedented challenges brought on by rapidly evolving technologies, an unforeseen pandemic, and an increased responsibility to keep our vital supply chains operational. Our teams combine the comprehensive business understanding that underpins disciplines with practical operations expertise in diverse industries worldwide. Using new tools and technologies that make real-time information available to carriers, shippers, and their land partners (mass transit, for instance) could help all stakeholders along the value chain improve how they plan and execute operations, including carriers themselves. By providing more upstream visibility—a centralized database offered through a web-based, open platform is one way to do this—carriers can, again, tap new pools of cost-cutting opportunity and help shippers reduce the costs and complexity of their own supply chains.

We Build Strategies and Translate Industry-Specific Trends into Actionable...

We Build Strategies and Translate Industry-Specific Trends into Actionable...

Our models cover the entire energy value chain and work interdependently to answer any “what if” scenarios based on your organization’s specific needs. We use our cross-industry supply-chain expertise to help navigate the sector’s ever-larger and more complex supply-chains.

Floating Production Facilities and Subsea Infrastructure. To prevail in current markets, successful businesses treat strategy development as a dynamic process. Commodity-price fundamentals are challenging in the short term, requiring executive teams to constantly reevaluate mid- to long-term expectations. As a result, companies in the oil and gas industry are confronting significant strategic challenges and complex decisions, daily. To help our clients manage this complexity, we bring distinctive propositions to our advisory work, ranging from tools that target short-term cash and performance enhancements, to levers for enabling operating-model evolution, to proprietary market models that provide granular, rigorous supply-and-demand scenarios to support strategy planning and development.

Recent years have brought significant structural shifts to energy-demand drivers. Challenges such as slowing global economic growth, stricter greenhouse-gas-emission targets, unpredictable oil-and-gas geopolitics, and numerous technological breakthroughs have threatened existing business models. In response, decision makers across a range of industries are compelled to rethink their investment strategy, manage risks, and capture growth opportunities. Our team of energy-demand experts and our suite of integrated models provide a unique perspective on the dynamic energy transition, including specific insights on the transport, industrial, buildings, and power sectors.

We Provide Strategic Infrastructure Consulting to Aviation and Government Authorities

We Provide Strategic Infrastructure Consulting to Aviation and Government Authorities

We help local governments create and preserve value by providing advice and analytics on managing project risk exposures, selecting design strategies, and capturing value-engineering opportunities.

Leveraging Airports and their Surrounding Communities for Regional and Economic Growth. Market liberalization demands new solutions from air transport companies. Customers require flexibility, speed, and punctuality. Competition from other modes of transport—both road and sea—are capturing a share of the market that air traditionally had to itself. Today’s airports must evolve to meet growing demand, new technologies, updated security requirements, and rising customer expectations. These forces will grow stronger, as will the complexity of projects and the public’s desire for transparency into performance. We help companies in the general aviation market strive for operational improvement. We work end-to-end—from diagnosis to delivery of lasting impact—together generating tangible results that are improving the lives of people worldwide.

With the right digital and technological tools and effective organizational and operational setup, government leaders can increase the speed and scale at which they deliver for their people. We help governments manage technology and operational changes so they can work at increasingly higher levels. We bring deep industry expertise and local market insights to help our clients solve their most important challenges in strategy, organization design, and commercial operations. Our experience encompasses all aspects of airfield development including runways, taxiways, aprons, and runway safety areas. We provide airport financial consulting services, from project feasibility to regulatory and funding advisory to financial planning and alternative project delivery.

Innovation for Foundry Equipment Manufacturers and Industrial Machinery Companies

Innovation for Foundry Equipment Manufacturers and Industrial Machinery Companies

We help leaders transform operational performance and deliver change improvements across the value chain—from resource efficiency to capital management. We help organizations develop, refine, and implement plans to achieve profitable growth even as demand for traditional pulp and paper products is rapidly changing.

Modernizing the Pulp and Paper Industry. The world of paper and forest products is both rooted in tradition, centered as it is on the harvesting of basic materials and undergoing enormous change as consumption patterns evolve. We help companies improve operating efficiency and effectiveness, deploy lean approaches, build operating skills, and adopt proven tools to eliminate waste. We also help companies respond to opportunities to innovate both in operations areas such as energy consumption and in product supply-chain. We partner with companies and governmental agencies to understand and respond to global and regional growth opportunities as well as trends such as the rapid transition to digital platforms that reduces demand for traditional paper products in most markets.

Our consultants have deep expertise in the manufacturing methods and requirements of discrete industries, such as automotive and assembly, as well as process industries, such as pulp and paper and bulk chemicals. We have a unique understanding of our clients’ customers, the industries in which they work, and the trends that shape those industries. Our experts also bring the latest thinking on automation technology to each client project. Our productivity teams bring cutting edge knowledge, cross-industry experience, and leading practices in product process optimization to help companies address common operating challenges. These include enhancing equipment efficiency in operations as well as in manufacturing facilities, converting facilities to respond to shifts in capacity of production around the world, refining operations to respond to the rising cost and declining quality, and increasing operators’ energy efficiency.

Helping Metals and Mining Companies Create Lasting Impact in Changing Environments

Helping Metals and Mining Companies Create Lasting Impact in Changing Environments

We work with clients to build capabilities, adopt digital and analytics tools, and transform processes to improve their business in substantial, sustainable ways. Our approach combines a deep understanding of industry dynamics with advanced analytics and an unparalleled network of experts.

Sustainable Extraction and Processing of Raw Materials. We are trusted counselors, bringing a top-management perspective to mining and metals companies’ most important opportunities and challenges. We guide clients to embed agile ways of working and continuous improvement at scale through management systems, culture, and building capabilities, such as lean management programs. We offer objective perspectives rooted in knowledge and analysis and work collaboratively with our clients to shape high-impact, creative, workable solutions. We offer our clients unique insights on supply, demand, trade flows, and future prospects for major mining commodities. Our strategy work spans growth, corporate and business unit strategy. In performance transformation, we help drive large-scale culture change alongside operational improvement. We offer a suite of proprietary tools, covering everything from operational benchmarking to plant simulations. We collaborate with global institutions, metals associations, and policymakers to help shape the industry’s future.

Building Resilience through Procurement Analytics

Building Resilience through Procurement Analytics

We help utilities and independent power producers to become world-class purchasing leaders by adopting advanced procurement and supply-management capabilities across materials, services, operating, and capital-spending categories.

Optimize Earnings and Volatility with Advanced Analytics. Recent developments in unconventional energy have delivered huge technical gains, yet industry economics remain challenging. In an environment where improving efficiency and reducing costs are imperative, we help operators eliminate waste and variability, optimize material and resource planning, share data and best practices, and identify and capture opportunities as they emerge. Regulatory environments, globalization, industry boundaries, and cost pressures are all in perpetual motion, and idleness is never an option. Change in business is constant. As a result, companies in the oil and gas industry are confronting significant strategic challenges and complex decisions, daily. To help our clients manage this complexity, we bring distinctive propositions to our advisory work, ranging from performance enhancements, to levers for enabling operating-model evolution, to proprietary market models that provide granular, rigorous supply-and-demand scenarios to support strategy planning and development. In addition to providing strategic project management advice, we are committed to building clients' capabilities at all levels of an organization to ensure success. Leveraging data and technology, our world-class team of data scientists and analysts enable organizations across the entire value chain to make well-informed strategic, tactical, and operational decisions. We turn data into action to help organizations capture opportunities, manage risk, and improve performance.

Combining Innovative Data and Analytics to Monitor and Forecast Independent Supply Dynamics

Combining Innovative Data and Analytics to Monitor and Forecast Independent Supply Dynamics

We help clients better manage market volatility, address liquidity risk, and improve trading and operations. We help clients unlock the full value of their oil and gas assets in a sustainable way using a combination of deep industry expertise and reliable, tested solutions and services.

Optimize Well Performance and Mitigate Risk with Precise Geomechanical Insights. Approaching net zero requires companies to take a comprehensive look at their systems, from product design and supply chain to manufacturing and operations in order to determine where the carbon is and the best method for removing it. We work with companies at all stages of maturity to accelerate their journeys toward sustainability. We work side-by-side with our clients to design and implement operational change and deliver improvements that last. Success requires complex trade-off decisions that span product design, supply chains, industrial processes, distribution networks, and technology innovation. We help companies identify decarbonization opportunities that work both environmentally and financially.

We help clients identify and adapt proven best practices from other industries to create opportunities on supply chain optimization, process digitization, learning curve benefits, planning, and contract innovation. Our teams review the cost efficiency of the energy and resources used in manufacturing and leverage new sources to create emission-free and waste-free plants. We perform complete product teardowns that include assessing value, resources, product circularity, and emissions, as well as identifying opportunities to substitute lower-carbon/less resource-intensive components without sacrificing performance or margin. We identify the suppliers, technologies, and developers needed to remove carbon from the supply chain, focus on low-carbon procurement and logistics, and improve the carbon footprint of existing suppliers. We take an enterprise resource planning view of how much carbon is being used at each step of the supply chain, targeting areas for the greatest carbon-reduction opportunities, and tracking the transformation’s progress.

We Help Companies Improve Performance through Data-Driven Benchmarking Analytics

We Help Companies Improve Performance through Data-Driven Benchmarking Analytics

We help electric- and gas-network owners and operators achieve world-class operating- and capital-expenditure performance, create value from emerging technologies, and meet the growing need for reliable energy. We help utilities, investors, and governments to take well-informed strategic and financial decisions and execute in a rapidly evolving and increasingly volatile energy environment.

Grid-Connected Renewable Energy Systems. Implementing regulatory and external-affairs strategies requires top management commitment, cross-functional engagement, and organizational drive. We help clients allocate resources, recruit the right talent, and establish procedures to secure stakeholder support for strategic priorities. We bring deep expertise in the evolution of power markets and assessing the implications for long-term portfolio planning, asset valuation, and investment. Our comprehensive methodologies are built on a foundation of industry expertise, proprietary intelligence, and internal and external data sources. We constantly refine our methods and models to produce the most relevant and valuable reports possible.

Our team of experts provide actionable insights in order to meet the business challenges unique to each client. We use a combination of technology, workshops, and reports to deliver road maps that help leaders prioritize business innovations. Our services include floodplain studies, stormwater management, coastal engineering, wetland restoration, environmental site assessments, and water resources planning and design for transportation and water infrastructure programs.

Innovative Funding Strategies for Hydropower Infrastructure and Technologies

Innovative Funding Strategies for Hydropower Infrastructure and Technologies

Our team helps clients develop the best consortium to deliver and operate the asset under development. We support leading investors in developing sustainable investment strategies that couple competitive financial returns with wider environmental and social benefits.

Locks and Dams, Reservoirs, and Earthen Levees. We help private- and public-sector clients manage water and waste to capture economic and social benefits, reduce cost, and minimize risk. We help local and national governments assemble a fact base for decision making, craft strategies for stakeholder management, identify least-cost solutions through tailored cost curves, assess barriers, and produce practical implementation plans. We help utilities transform their operations along the entire value chain of water, waste, and wastewater by optimizing elements such as network and pump station maintenance, pump energy efficiency, sludge treatment, waste asset configuration, aeration control, and support functions. By applying nontraditional approaches to analytics, we help clients generate insights into their risk exposures and decisions. Drawing upon extensive experience in capital projects we use best practices—such as Earned Value Management (EVM) and CPM Schedule Management—to build client capabilities and safeguard the long-term success of a project.

We have an unparalleled end-to-end view of risk management processes, combined with a proven digital delivery capability and construction-leading expertise and methodologies in data management and analytics. These capabilities, along with deep operational expertise across a range of sectors, leading-edge technology experience, and a finger on the pulse of emerging innovations in financial technology and regulatory technology, make us an invaluable partner for our clients. Our resulting tool set includes diagnostics for assessing our clients’ current risk data and technology capabilities, digitization and analytics potential, and tools to help clients adopt architectures built on sound practices for infrastructure, applications, and data. Using these tools, we help clients reduce capital demand, enhance liquidity management, enhance reporting capabilities, improve transparency and decision making, increase operational efficiency, and develop more rapid and accurate pricing processes.

Harnessing the Power of Advanced Analytics in Transmission and Distribution Systems

Harnessing the Power of Advanced Analytics in Transmission and Distribution Systems

We help clients develop profitable, robust, and scalable investment portfolios that capitalize on technologies. We help electric-power generators enhance revenue, reduce costs, and transform fleet performance.

State-Owned Utilities and Cooperatives. We help clients achieve significant improvement in their quality performance, customer satisfaction, and regulatory compliance. Our areas of quality expertise include development of quality and compliance strategies, quality performance and cost benchmarking, optimizing the quality management system, delivering compliance and remediation services, fostering a quality culture. We support clients with specific challenges, ranging from capital productivity and investment to digital and analytics and from restructuring to energy policy and regulation. In addition, we advise utility-service providers and technology manufacturers on strategy, serve financial investors through evaluations and due diligence, and support public-sector institutions and their partners with policy design. The deep expertise of our leadership team and practitioners is backed by an unparalleled global network of consultants and specialists with cutting-edge knowledge of industry, functional, and cross-sector topics.

By applying a systematic approach, we help assess the full range of private and public options for funding infrastructure assets. Our proprietary models enable us to identify risk, advise on pricing, and assess risk-based mitigation approaches and their implications on financing strategy. We help clients directly link their corporate and business unit strategies to their various financing strategies. We help conduct technology and target scans for investors and entrants from adjacent businesses and offer guidance on developing entry strategies, capturing opportunities, and building scale. Finally, by leveraging our vast network, we can facilitate connections to alternative sources of capital for our clients’ infrastructure projects.

Engineering, Procurement, and Construction Management Support

Engineering, Procurement, and Construction Management Support

Our consulting partners are well-established members of the nuclear industry and has extensive experience not only in nuclear projects undertaken and funded by governments, financial institutions and the private sector, but also in the development of regulatory and legal regimes for the nuclear safety legislation sectors.

Value and Resilience through Better Risk Management. The nuclear power industry is still growing in Eastern Europe, parts of Asia, and the Middle East even as it contracts in Western Europe and North America. Nanoscale science and research promises to be a major component in the future growth of the global economy. Advances in nanotechnology are coming at a rapid-fire pace and are greatly influencing the long-term outlook for a range of scientific and engineering disciplines. Companies are investing billions each year on nanotech research and development, while governments are also engaged: the United States government alone has appropriated more than three billion dollars in funding, which puts nanotech on course to become one of the largest government-funded initiatives.

Our understanding of risk-based informed decision frameworks and the need for projects to be commercially attractive and viable have positioned us as a market leader for large scale construction projects such as a nuclear cogeneration systems. We support clients with dedicated teams, industry-specific tools and models, and field-tested approaches. Our professional services include planning, scheduling, performance reporting, earned value management, risk management, change and cost control, and program and project analytics.

Understanding Medical Research Requires Extensive Scientific and Industrial Expertise

Understanding Medical Research Requires Extensive Scientific and Industrial Expertise

Community Hospitals, VA Hospitals, Children’s Hospitals, Ambulatory Healthcare and Academic Medical Centers

Unique Purpose-Built Research Labs. Healthcare improvements have dramatically increased life expectancy, and new treatments are improving quality of life. We work with private and public healthcare leaders to identify innovative ways to tackle the biggest healthcare challenges and improve the productivity and quality of healthcare delivery. We support construction end to end, including strategic alignment, design, procurement, and execution. Our clients typically save five percent of in-scope capital expenditures while increasing on-time delivery, improving customer experience, and maintaining flexibility. Additionally, we help optimize the process for medical-equipment procurement.

Our team of clinical innovation, product development, process design, construction management and experiential modeling experts utilize some of the most inventive approaches available to help our clients identify their most significant strategic and operational opportunities. We have worked with many of the largest private and public health systems in the world on frontline-driven clinical operations improvements. Drawing on a broad range of services that includes architectural design, engineering, construction management, and facilities optimization services, our solutions are driven by understanding how our clients define value and how we can help them improve performance. We help build internal facility management capabilities to ensure the impact endures long after the initial project concludes.

Delivering Precision with Ingenuity and Teamwork

Delivering Precision with Ingenuity and Teamwork

We help companies unlock value by leveraging their purchasing to provide actionable insights that enable continuous impact in procurement. We work with original-equipment manufacturers, from passenger-car and light-truck manufacturers to heavy-truck makers and to agricultural and construction-equipment manufacturers.

A Reliable Partner for Efficient and Cost-Effective Project Delivery. The machinery industry is quite diverse, and many of our clients face similar challenges. To effectively serve our clients, we have built a committed group of experts focused purely on machinery topics. For example, to help these companies deepen their core competencies of great engineering and design of distinctive products, we work with them to develop finely tuned strategies and detailed customer insights.

Many of our insights have been drawn from high-volume industries, but we have customized each to the environment and the challenges faced by machinery clients. The depth and breadth of our expertise is unmatched. We serve clients at every level of their organizations, in whatever capacity we can be most useful, whether as trusted advisors to top management or as hands-on coaches for front-line employees. Our solutions are practical, intuitive tools that help people at all levels of an organization generate the insights they need to address both strategic and day-to-day decisions. We work closely with clients to embed our tools, analytics, and expertise and provide ongoing support to help them build the capabilities they need to revolutionize how decisions are made. We equip decision makers in both public and private sectors with key insights to make faster, more informed decisions and uncover new sources of value.

Amplifying the Fan Experience

Amplifying the Fan Experience

We work with governments and private-enterprise to design and deliver strategies that unleash growth and capture economic opportunity. We help clients improve performance by designing portfolios—supported by resource reallocation, integrated project strategies, and planning processes—that position them for success.

Football Stadiums, Basketball Arenas, and Baseball Parks. Economic output is directly tied to an ability to move people in a cost-effective manner. However, developing—and maintaining—the necessary infrastructure is challenging, with planners and policy makers often balancing complex political, fiscal, social, and environmental tradeoffs. Faced with large capital investments and increasingly strained public finances, shareholders have a difficult choice: optimize an existing asset, or build something new. We combine deep knowledge of individual asset classes— sports stadiums, arenas and venues—with distinct functional expertise. By drawing on our deep insights and applying best-practice tools and methodologies, we bring a fresh perspective to complex problems within the sports industry. We apply our knowledge of construction to help clients engineer optimal public buildings and spaces. We support clients in aligning architectural design and public objectives with capital and operational expenditure budgets. To ensure the long-term relevance of building structures, we advise clients on the strategic use of materials and on design, expansion, accessibility, and sustainability techniques. We support all phases of project execution—from design to construction, from equipment to commissioning. We take a holistic view of public infrastructure projects, helping clients optimize quality, minimize costs, and keep projects on schedule.

We Help Leaders Develop Strategies, Focusing on Processes that form a Sustainable Business Model

We Help Leaders Develop Strategies, Focusing on Processes that form a Sustainable Business Model

Hospitality projects come with built-in tensions that often discourage trust-based cooperation and can result in disputes and variations that bust budgets and deadlines and compromise productivity. Increased collaboration can help align stakeholders, inspire innovation, and establish outcome-focused progress.

Luxury Resorts, Hotels, and Casinos. The global economy depends on connection – fluid channels through which people and goods move across skies, roads, rails, oceans, and waterways with speed, safety, and efficiency. The growing sophistication and complexity of the travel, logistics, and supporting transport infrastructure sectors has helped to fuel global economic growth, but it has also revealed vulnerabilities. Industry leaders today face unprecedented challenges brought on by rapidly evolving technologies, an unforeseen pandemic, and an increased responsibility to keep our vital supply chains operational. We bring a deep understanding of how the travel, logistics, and transport infrastructure sectors work, and our extensive experience, advanced analytics, and unparalleled network of experts gives us a unique ability to turn threats into opportunities. As industry standards and practices continue to evolve, there is an opportunity to incorporate new technologies and methodologies that will define a new era of modern travel. We help leaders develop strategies that can evolve to meet shifting traveler tastes, focusing on building processes and capabilities that form a sustainable business model. By integrating and adopting new ways of working, we’re helping companies build resiliency for the future.

We understand the challenges that restaurant owners, hotels and Vegas casino developers face in assembling land, obtaining gaming approval, and creating facilities that will stand out in fiercely competitive markets. Our work spans the globe on topics such as planning and investing in infrastructure, architecture, engineering, and construction. Our deep expertise enables us to assist hospitality clients in developing programs for a new future. We also rely on the practical experience of our project teams to develop new concepts and consulting approaches. We use innovative approaches to tailor offers precisely to customer requirements and to align process flows and organization structures with new strategies. In addition to hotels and casinos, we are highly regarded for our performance on recreational sports and entertainment venues, commercial developments, and corporate campuses.

We Help Defense Agencies address their Most Fundamental Organizational Challenges

We Help Defense Agencies address their Most Fundamental Organizational Challenges

Our approach combines a deep understanding of industry dynamics with advanced analytics and an unparalleled network of experts. We work with clients to build internal capabilities, adopt digital and analytics tools, and transform work processes to improve their business in substantial, sustainable ways.

Designing, Developing, Building and Supporting. We help our clients diagnose their organizational effectiveness, and develop strategies to improve these key levers of performance. Our clients range from equipment manufacturers for aircraft in the commercial, business, commuter, and military sectors to defense contractors to satellite and transportation firms. Our teams serve commercial aerospace leaders in most segments of the industry. We partner with these organizations to help them improve operations, program affordability and growth. We have long-standing relationships with ministries and departments of defense, helping them rescale their personnel, operations and maintenance and procurement programs as defense commitments change.

We help clients leverage digital capabilities and advanced analytics to reach new levels of operational performance. Our solutions are suitable for all products, regardless of volume or complexity. We combine deep international experience in national security with global expertise that spans industries and the public, private, and social sectors. We bring a range of proprietary tools and a wealth of experience to help public-sector clients, in particular in the areas of organizational design, organizational diagnostics, and transformational change. Our global teams of procurement experts help our clients address the complex management issues at the heart of aerospace and defense.

Developing Engagement Strategies to Improve Feasibility of Municipal Projects

Developing Engagement Strategies to Improve Feasibility of Municipal Projects

Combining economic and social development experience with our financial modeling expertise to develop cities and infrastructure. Supporting organizations looking to enter a partnership with another institution by helping clients assess the potential, design the structure, and ensure the long-term success of the new venture.

Strengthening Public Sector Planning and Execution. Investing in infrastructure is a critical tool to create jobs, drive economic recovery, and position our economies for sustainable growth. Advanced and emerging nations alike face major, albeit different, obstacles to stable and inclusive economic growth. Advanced economies strive for human-capital development, sustainable growth, and productivity improvement in the public sector. Developing economies must balance the benefits of economic progress against societal and individual costs. Much progress has been made in the past century in raising individuals and societies out of poverty. Continuing this progress will require a significant and sustained global focus on economic development. And unlocking economic growth will require smart strategies for overcoming growth obstacles such as natural disasters and the effects of climate change. We help governments and public-sector organizations design and implement large-scale strategies that promote economic development and inclusive growth. We are at the forefront of working with organizations to digitize their risk functions, helping them transform risk management to improve operational efficiency and effectiveness while enhancing the quality and speed of decision making. This strengthens not only risk management but also overall financial management, through better data governance and architecture, and improved processes and analytics.

We work with organizations to plan and develop cities that support growth, without compromising environmental or social sustainability. We aim to resolve the critical issues faced when planning, financing, developing, constructing, and operating infrastructure projects to reduce cost and accelerate and optimize projects.

Collaborating with City Government. Economic opportunity is deeply rooted in neighborhood conditions. Where people reside has lasting impacts on how they live, from life earnings to life expectancy. Yet even with broad economic growth, many neighborhoods continue to struggle with concentrated poverty, disinvestment, unemployment and other challenges. Cities are essential to global economic growth and productivity. They are where most of the world’s population lives, works, and plays, and they are important to everyone. We work with organizations to plan and develop cities that support growth, without compromising environmental or social sustainability. We aim to resolve the critical issues faced when planning, financing, developing, constructing, and operating infrastructure projects to reduce cost and accelerate and optimize projects. We work with city leaders on protecting and improving the environment for city dwellers, workers, and visitors while pursuing economic growth and social progress.

We help city leaders to tackle sustainability challenges, improve the quality of life in cities, and pursue smart growth by integrating environmental thinking into everything they do. As trusted partners of city governments throughout the world, we help shape strategy, enable change, and support delivery in sustainable city initiatives. Sustainability is a part of every aspect of our work with city leaders, both in setting priorities and in delivering transformational impact on the ground. To support governments, the private sector, citizens and other stakeholders, we draw on the global resources of our firm, including capital productivity, economic development, technology design and delivery, and performance management expertise.

Sustainable Economic Development Strategies for America’s Heartland

Sustainable Economic Development Strategies for America’s Heartland

We help national governments and development partners in emerging economies develop their agriculture sectors, and we work with donor agencies and foundations that support rural agriculture. We help consumer-packaged-goods and processing companies improve performance within their raw-agricultural-materials procurement and risk-management functions.

Economic Development Strategies for Rural Communities. We combine leading-edge investor insights honed by our private equity experts with agriculture-market insights and proprietary tools to help clients with their range of needs. We support all types of investors across the full investment cycle, including private equity funds, pension funds, venture capital funds, and sovereign wealth funds, on many topics including thesis development, due diligence, and operational improvement. We apply our expertise in agribusiness, supply-chain management, infrastructure, and large-scale transformations to create models for sustainable agricultural development that attract private, public, and social investment and can be scaled and delivered effectively. These models include regional “breadbaskets,” infrastructure and logistics corridors, and dedicated agricultural economic zones.

Building and sustaining resilience is more important than ever in an industry strongly linked to annual cycles, external factors like weather and volatility in commodity prices, and the uncertainty in today’s geopolitical and macroeconomic environment. Our approach combines proprietary tools and techniques with unmatched industry and functional knowledge to promote sustainable change. We work closely with governments, foundations, and businesses to design programs that transform the way agricultural systems operate. In addition to our work on strategy, design, and implementation, we help set up and accelerate public/private partnerships, support individual value-chain projects, and tackle questions on organizational and strategic topics for corporations and foundations.

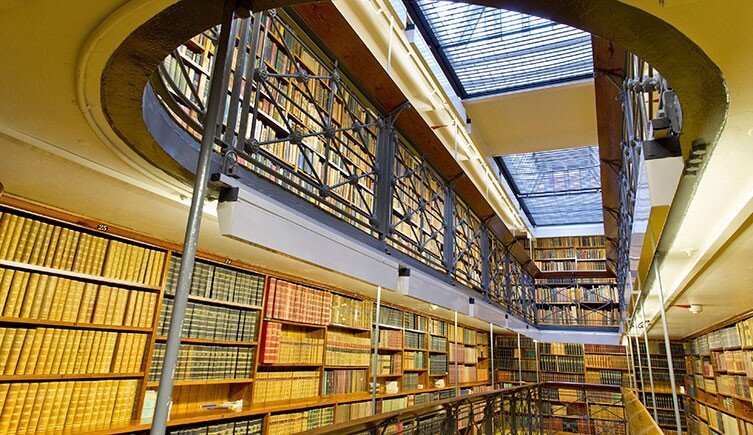

Re-Imagining where Learning takes place at Colleges, Universities and Vocational Programs

Re-Imagining where Learning takes place at Colleges, Universities and Vocational Programs

Building, deploying, and accelerating ventures to scale and improve education and employment outcomes to deliver capabilities that enable our clients to repeat the process time and again, bringing together the world’s top educators, designers, constructors, and other experts across all sectors and geographies.

Facility Management for Distributed Fixed Assets. We work to improve educational and employment outcomes, helping create prosperous societies that provide equal opportunities. We help school systems to bring about rapid improvements in literacy and numeracy outcomes at the classroom level through our work across diagnostics, strategy, and implementation. We work with public and social institutions to apply innovative digital tools to revolutionize teaching and learning both inside and outside the classroom. We collaborate with employers, education providers, and governments to help students make a seamless transition from education to work. Our teams include former teachers, institutional leaders, researchers, and public policy makers. We engage with a wide variety of academic, cultural, and educational institutions, as well as other philanthropic foundations. We prioritize collaboration and value diversity, creating a culture that fosters inclusiveness, teamwork and an entrepreneurial mindset in the pursuit of professional excellence.

We support owners planning construction projects by developing business cases aligned with their long-term strategic objectives, by ensuring rapid and effective decision making through our proprietary Construction Management System, and by performing key analyses to monitor the progress, economics, and risk associated with the project. During the construction phase, we take a hands-on approach to help select and manage contractors, optimize procurement strategies, and monitor the overall execution of the project. All the while, we ensure the client’s objective—delivering this project on time and within budget—remains the top priority.

We Help Charitable and Faith-Based Organizations Develop Strategies for Building Programs

We Help Charitable and Faith-Based Organizations Develop Strategies for Building Programs

By embracing ownership in both design and construction, we become stronger partners in delivering the outcomes our clients seek. We help deliver projects through a disciplined execution rhythm to accelerate schedules, improve safety, maintain quality, and reduce costs.

Preservation of Buildings of Architectural and Historical Significance. Our team provides a unique combination of project development and financing expertise, relationships with key stakeholders, and proprietary tools and data that enable us to serve as trusted partners to governments, private developers, and investors. Our project-development work focuses on helping bridge the current gap between infrastructure investment and needs by convening the right parties and collaborating to establish viable, bankable infrastructure projects in which investors can be confident. We apply our knowledge of architecture, engineering and construction to help clients design optimal buildings and spaces. We support clients in aligning design and public use objectives with capital and operational expenditures. To ensure the long-term relevance of buildings, we advise clients on the strategic use of materials, expansion, accessibility, and sustainability techniques. We help clients control facility management costs, while maintaining high-quality buildings with long lifecycles.

We help deliver projects through a disciplined execution rhythm to accelerate schedules, improve safety outcomes, maintain quality, and reduce costs. We ensure stakeholders are aligned and project outcomes are mutually beneficial, while advising on risk and regulatory management. We balance technical and commercial design considerations and support building capabilities that enable project leaders to make appropriate trade-offs. We apply design-to-cost and design-to-market principles to maximize the value of infrastructure through proprietary tools and methodologies like engineering trade-off approaches, construction cost and benchmarking analysis. We optimize costs and align the incentives of downstream suppliers and subcontractors through our category consolidation approach and supplier trainings. We implement schedule management techniques such as Critical Path Method (CPM) and Earned Value Management (EVM) to improve productivity. We balance short- and long-term considerations to minimize maintenance costs once an asset is in operation.

Engaging, Connecting Culturally and Linguistically Diverse Communities

Engaging, Connecting Culturally and Linguistically Diverse Communities

Our commitment to fighting world hunger, poverty, and malnutrition can be seen in our support for governments, organizations, and civil society tackling complex challenges. We have proven experience in managing complex donor-funded programs and projects for multilateral development banks and bilateral donors.

Humanitarianism, Philanthropy, and Humanitarian Diplomacy. We all have a role to play in building a better world for our children. In our own case, we were exceptionally fortunate to inherit a unique philanthropic tradition based on a longstanding commitment to solidarity, social responsibility and the advancement of knowledge. Today it is our turn and our duty to preserve this legacy. By helping new talent emerge, and by devising innovative solutions to current challenges, the Burk Family Foundation works each day to ensure that our vision will translate into lasting achievements in science, the environment, the arts, education and social entrepreneurship. The projects we support provide the best illustration of our commitment to the value of sharing and our pursuit of excellence. We support leading international development agencies, governments, and private donors in making their operations more efficient and effective, developing cutting-edge strategies and initiatives, and bringing projects to a successful conclusion on the ground.

We help philanthropists achieve their vision by supporting the design of new philanthropic entities or projects—including foundations, limited liability companies, public-private partnerships, hosted philanthropic initiatives, and multi-donor collaborative platforms—encompassing strategy design and operating model. We help philanthropies partner with other donors or funders in order to amplify the scale of their impact and designing the strategies, operating models, and governance models of major philanthropic collaboratives that pool capital or facilitate strategic alignment among multiple donors. We help private and corporate foundations, as well as individual philanthropists, to develop strategies for achieving systems-level social impact. We draw on deep expertise from across our global firm—in agriculture, economic development, global public health, financial inclusion, environmental sustainability, infrastructure and urban development, education, and equity—to help philanthropic organizations tackle society’s greatest challenges.

Regional High-Speed and Intercity Passenger Rail Public-Private Partnership

Regional High-Speed and Intercity Passenger Rail Public-Private Partnership

Our integrated approach brings together functional and sector specialists who can be on the ground where and when organizations need them, guiding capital projects for public- and private-sector entities in sectors including real estate and infrastructure development, transport and logistics, and port-and-shipping sector.

Federal Transit Capital Investment Grant Funding. Public transport is a large part of daily life and generates substantial revenues. Yet the industry also faces significant challenges. Competition is encouraging new solutions in this arena to which established companies must adapt. Public transport companies must learn to operate more efficiently. An integrated perspective is critical for key stakeholders to adopt since the various mobility trends—infrastructure, autonomous driving, connectivity, decentralization of energy systems, electrification, shared mobility, and public transit—are interrelated and will affect both consumers and businesses alike. The vision for the public transport players of the future is a significant decrease in operating costs and improvement in customer satisfaction. We aim to help all stakeholders in the mobility ecosystem navigate the future by providing independent and integrated evidence about possible future mobility scenarios. We work systematically to achieve best-practice solutions through efforts such as cost restructuring, and distribution optimization. By leveraging economies of scale, horizontal integration, and specialization, we support our clients in achieving even greater efficiency gains.

Fashion Apparel and the Garment Industry

Fashion Apparel and the Garment Industry

A Luxury Rooted In Tradition

Vibrant, Inspiring, and Cosmopolitan. Driven by competition and consolidation, large, retail enterprises operate across countries, channels, categories, and formats. As the role of the brick-and-mortar store evolves, retailers will continually have to refine how they use their infrastructure. Over the course of the next decade, the face of the consumer industry will change dramatically. Retailers need more than a good deal to make a sale and keep loyal customers coming back. We pair extensive real estate and functional expertise with deep tenant knowledge across sectors to help organizations reimagine the role they play in space acquisition, development, and use. Our approach to construction provides us an opportunity to control costs and accelerate schedules before shovels hit the ground.

We craft a tailored package of talent, resources and processes — under the right delivery method — to deliver a solution that’s a perfect fit for your specific needs. We believe in a fully-integrated design-build approach that combines design, engineering, construction, and business strategy as the core of any group. These functions should work together to make decisions, ensure that the designed journey aligns with the business strategy and delivers value, and keep the client experience at the forefront. We systematically apply design-to-engineering and design-to-market principles. Our clients range from medium-size companies to industry leaders—spanning across producers and brands, vertical fashion retailers, apparel multi-brand retailers, department stores, and luxury-goods companies.

Modern Art Museums and Cultural Institutions, Historical Monuments, Science and Innovation Centers

Modern Art Museums and Cultural Institutions, Historical Monuments, Science and Innovation Centers

Our experienced team partners with institutions large and small, including historical societies, libraries, universities and art museums—both encyclopedic and niche in scope. We help individuals, philanthropists, businesses, social entrepreneurs and investors to drive change by becoming more strategic and effective.

Cultural Expression through the Arts. The history of a community contributes to its personality. Preserving the history of a place through its significant historic resources gives a community its unique character. Historic preservation provides a link to the roots of the community and its people. Overall, historic preservation adds to the quality of life making for a more livable community. Historic preservation involves much more than simply saving and restoring old buildings and sites of historic importance; there are economic, cultural, environmental, and educational benefits of historic preservation, all of which are inextricably connected to one another and to the living memory of involved communities. We have an unparalleled end-to-end view of risk management processes, combined with a proven digital delivery capability and market-leading expertise and methodologies in data management and analytics. These capabilities, along with deep operational expertise across a range of sectors, leading-edge technology experience, and a finger on the pulse of emerging innovations in financial technology and regulatory technology, make us an invaluable partner for our clients.

The Arts Ennoble and Inspire—Strengthen our Communities Socially, Educationally, and Economically

The Arts Ennoble and Inspire—Strengthen our Communities Socially, Educationally, and Economically

We embrace and enable cultural connections, spanning the visual and performing arts, music, literature, theatre and film, play a crucial role in making a more creative, equitable, and empathetic society.

Digital Engagement in Culture, Heritage and the Arts. Part of our philosophy is the belief that creativity, dedication and discipline can lead to outstanding achievement. The Burk Family Foundation is steadfast in its commitment to a new generation of cultural institutions that are critical in the revitalization of transitional neighborhoods. Our music initiatives focus on supporting and encouraging young people in exploring their potential. We continually seeks ways to foster creativity as a tool that can build more livable communities and serve as an important economic resource in their revitalization. Programs for emerging artists, musicians, and cultural institutions enrich cities, and bringing art into the workplace sustains an atmosphere that encourages the kind of thought-leadership that has been integral to our success. We help clients define their strategic approach to data for risk and financial management, lay out their implementation road maps in line with regulatory, business, and risk management requirements, and then rapidly implement these recommendations. This includes building capabilities in data and reporting governance, technology solutions, and architecture.

We Help Clients Achieve Extraordinary Risk-Adjusted Enterprise Portfolio Performance

We Help Clients Achieve Extraordinary Risk-Adjusted Enterprise Portfolio Performance

Organizations face growing threats due to non-financial risks—from compliance and misconduct to technology failures and operational errors. We provide enterprise-wide tactical solutions to manage these risks. Our unique end-to-end approach combines robust data management, innovative technology solutions, advanced analytics, and a deep understanding of broad architecture disciplines.